Our Services

Your Trusted Innovation Funding Partner

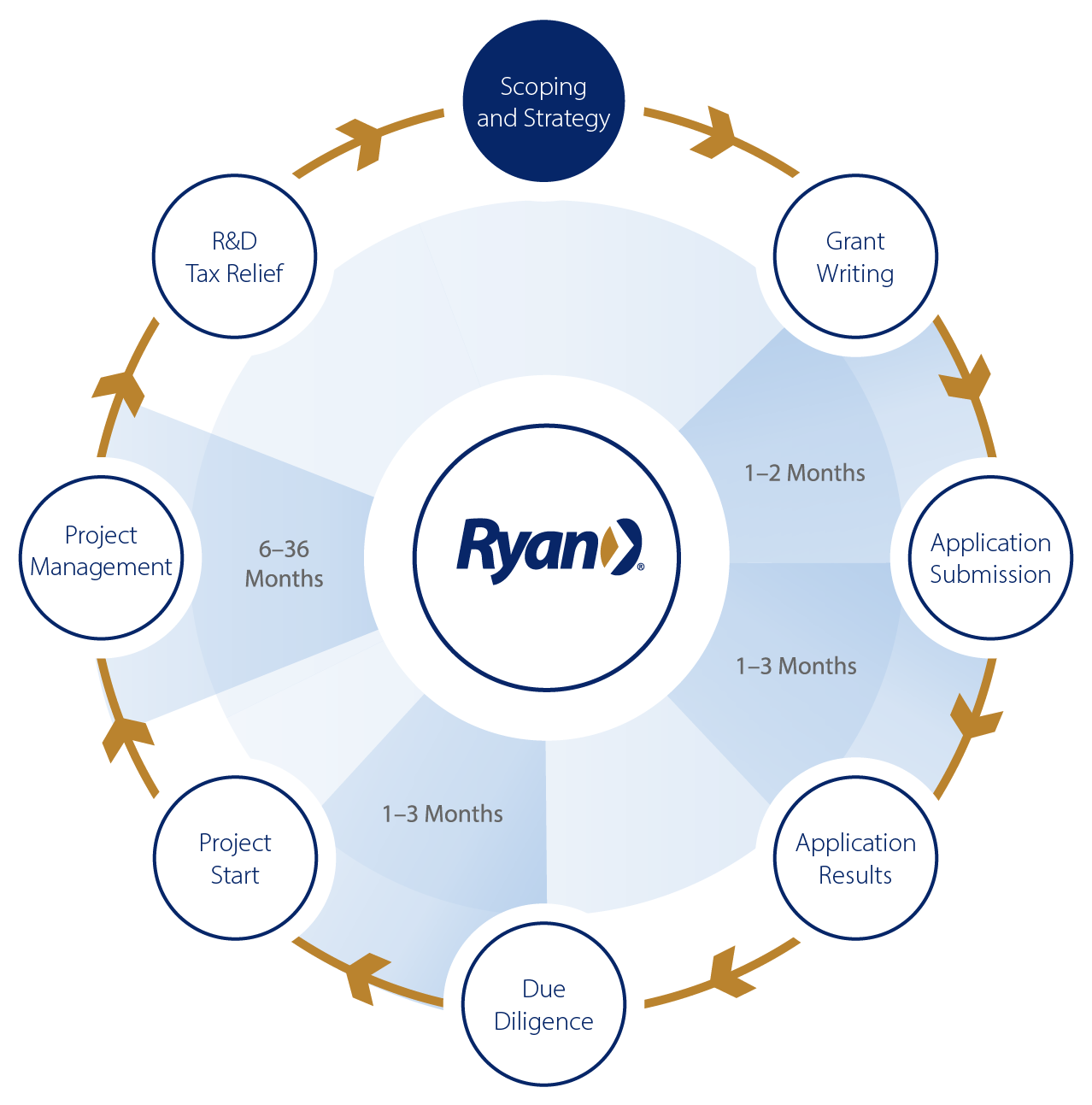

Ryan’s unrivalled expertise within innovation funding enables innovative companies to capitalise on tax incentives and non-dilutive funding opportunities. Through our Assess, Advise, and Transform model, Ryan guides your company through the complex funding landscape, securing funding to grow the business and fulfil its vision, whilst ensuring compliance through Ryan’s tech-enabled platform.

In the UK, Ryan’s innovation funding services support companies throughout the innovation cycle, ensuring government funding is considered at each stage of the journey. This includes grant funding, research and development (R&D) tax relief, the Patent Box, energy tax relief, and capital allowances.

We’ve helped return more than half a billion pounds in innovation funding to UK businesses.

Who Is Ryan?

Ryan, an award-winning global tax services and software provider, is the largest Firm in the world dedicated exclusively to business taxes. The Firm provides an integrated suite of international tax services on a multijurisdictional basis, including cost management, compliance, consulting, technology and transformation, and innovation funding.

Achieving international recognition and market leadership through client service excellence, workplace innovation, and team member development, thousands of businesses, including many of the world’s most prominent Global 5000 companies, trust Ryan with their end-to-end tax services.

With unrivalled expertise within innovation funding and tax relief, Ryan supports UK companies with their business growth by enabling them to fund their future. Our specialist team will assess your business’s eligibility for our wide range of innovation funding services, ranging from grant funding and the Patent Box to commercial property tax relief and R&D tax relief.

Don’t Just Take Our Word for It

Looking for help with an HMRC enquiry into your R&D tax credit claim?

Our R&D enquiry resolution service covers document preparation, strategic communication with HMRC officials, and thorough representation during any hearings or meetings.

Find out how we can support your business.

The Knowledge Hub

Read the latest news, insights, and thought leadership pieces on our Knowledge Hub, where we ensure you’re kept up to date with everything relevant in the innovation funding world.

What Grants Are Available Right Now?

Our dedicated team of market insight experts closely monitors the funding landscape, so we can rapidly match innovative projects to worthwhile opportunities.

Latest Grants Available

EUP OHAMR: Joint Transnational Call 2026

Closing Date: 2 February 2026 European Partnership call funds transnational projects developing new treatments and tools to combat antimicrobial resistance across One Health sectors.Innovate UK Growth Catalyst December 2025

Closing Date: 3 February 2026 Grant funding for late-stage research and development projects of up to £2 million in size, subject to aligned private investment.EIC Accelerator: Challenges and Open

Closing Date: 4 November 2026 The EIC Accelerator programme under Horizon Europe funds innovative startups and SMEs with disruptive products, high-risk projects, and strong scale-up ambitions.

Am I Eligible for Innovation Funding?

Evaluate your eligibility, receive tailored advice, and transform your business.

Discover your funding potential with our free innovation funding assessment tool.